How Is Business Processes Automation Driving Growth In The Global Financial Sector?

What is BPA?

Business process automation or BPA is a technology that leverages software robots, better known as bots, as its digital workers to undertake mundane, time-consuming, and repetitive tasks. These automated processes help stakeholders raise quality, efficiency, and streamline their business to contain costs while uplifting their worker morale.

Many businesses and industries like are working transforming their processes from paper-based systems and legacy electronics to BPA to help drive growth. One of these notable industries that are reporting constant growth is the Finance and Banking industry.

How is BPA helping Finance and Banking Grow Globally?

Trade finance drives a significant amount of revenue for banks globally. It totaled around $48B globally in 2018 and is expected to grow to 3TN in the upcoming years. Through their systems, banks help the various businesses and industries operating in this sector by providing surety for trades. They create or provide supporting documents such as letters of credit (LCs), provide short-term finance for the underlying products or services being imported or exported, or verify security or collateral.

However, to help international customers and businesses operate in this global market, financial institutions must manually check and verify paper documents that lead to significant delays and inaccuracies. Both banks and financial institutions must also comply with the region’s international trade organizations’ strict regulations. Moreover, frequently one trade can involve more than 30 parties and contain up to 100 pages, which are often hand-written or annotated documents. All these factors make these trades proceed at a snail’s pace, and costs financial institutions money.

To make all of these processes and compliance issues more efficient, financial institutions apply intelligent automation to trade finance and investing. These BPA bots are trained to digitize paper documents such as bills, packing lists, and invoices. They further help by classifying them and including their images in a single summary sheet that can be shared with the account managers and customers. These BPA processes help banks and institutions provide a faster turnaround, more accurate data, regulatory checks, more efficient organizational processes, and reduced processing time.

Conclusion

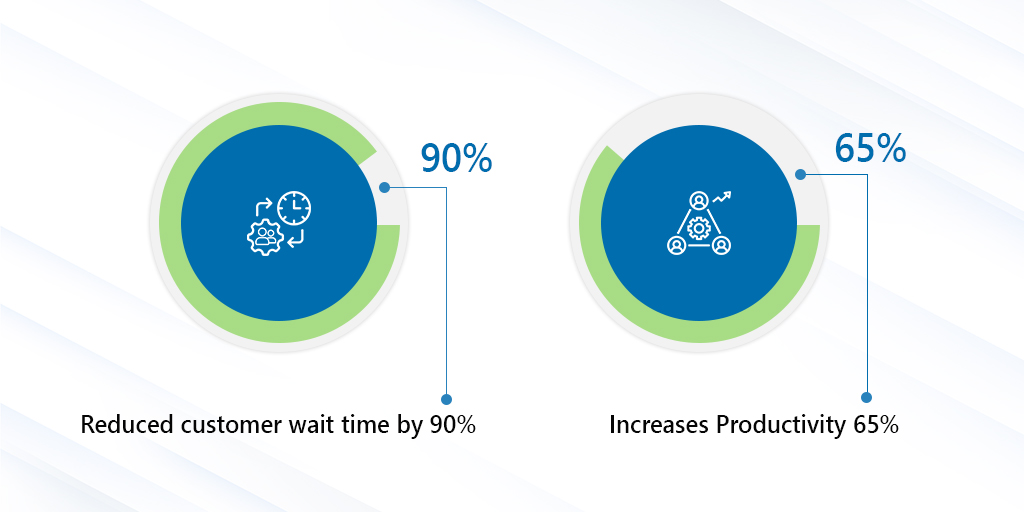

Although adoptions might at first glance look like a significant task, it is not. It can even be done remotely and help you transform your old legacy systems while integrating them in just a few minutes. That is why banks that have adopted business process automation report an improvement to their productivity by up to 65% and reduction their customer wait time by 90% at the same time.